Life is made up of promises, big and small. From marriages, to mortgages, to meals delivered on time, we depend on others—as they depend on us—to keep the promises that have been made.

Take the young man who pledges to be faithful to his young bride “till death do us part.” That’s a promise he can keep. Since it depends solely on his character, he can do it. That’s not to say he will, but he has the power to keep his word.

What if he further promises to “grow old” with his wife? That’s a beautiful sentiment, but who can “promise” such a thing? Who knows what the future holds?

I’ve learned that the art of promise keeping consists of knowing which promises are within your power to keep and which “promises” require outside assistance.

And that brings me to the value financial institutions can offer the public. They have the ability to make and keep promises that individuals normally cannot.

Consider the stunning promises made by banks, investment houses and insurance companies—and how those promises kept can help us keep our own financial promises.

Banks promise safety and liquidity. Banks guarantee that depositors’ funds will be both safe and available at any time. Perhaps you remember the scene in the 1946 holiday classic It’s a Wonderful Life. It featured a run on the town bank and a mob of nervous customers descending on the local Building and Loan to try to withdraw their money!

Depression-era financial panics like that are the reason the FDIC was created. Today the federal government stands behind the promises banks make to the public. Funds are insured, up to $250,000 per depositor per bank.

Investment companies promise access to markets. The promise that an investment company makes is access to fractional corporate ownership of the best-run companies in the world through liquid markets. Being able to own shares of stock in multiple companies across multiple industries lets individuals “diversify” their investments and reduce their risk.

Imagine trying to buy a $1,000 stake in a local bakery or body shop. People would likely laugh. But investment companies promise that you can enjoy such fractional ownership in publicly traded companies at a relatively low cost.

Insurance companies promise financial replacement of things destroyed or lost unexpectedly. With insurance you’re guaranteed compensation if you have a car wreck, a house fire, a severe illness, or a long-term disability. In the face of such disasters, this promise of financial remuneration means the world.

In the case of death, life insurance promises financial protection for survivors. This is especially important in the event of premature death. And for those who live to a ripe old age, lifetime income annuities promise income that will never stop no matter how long they live. These are enormous promises for those who live short lives or lengthy ones.

Healthy financial institutions have the size, strength, and flexibility to make and keep such promises. What’s more they can help you keep the important financial promises you’ve made.

Unfortunately, there is something these big institutions can’t do. They can’t force you to make important promises to your loved ones in the first place.

That process requires a wise financial plan. And sticking with such a plan requires character.

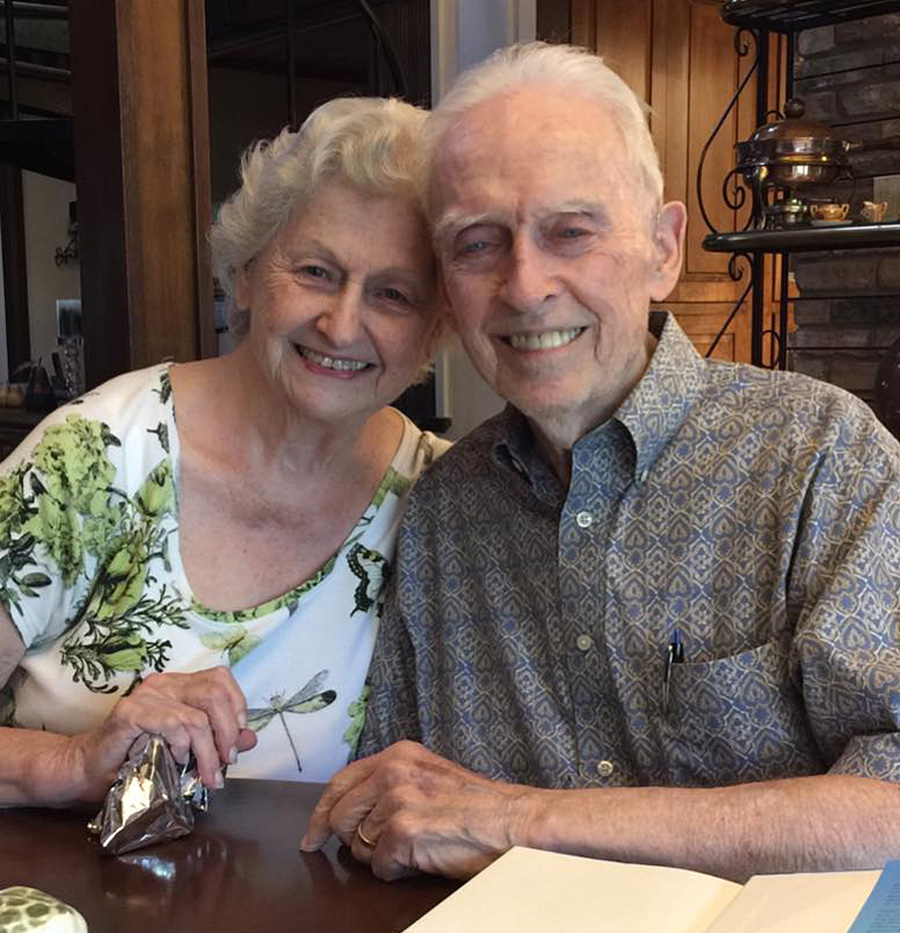

Speaking of character . . . my father passed away last week. He was 94. His was a long, good life of promises made and promises kept. When appropriate, he partnered with different financial institutions to make sure that the promises he made along the way would be fulfilled.

In life and in death, he taught me the value of a promise made . . . and a promise kept.

Thanks, Dad.

Argent Advisors, Inc. is an SEC-registered investment adviser. A copy of our current written disclosure statement discussing our advisory services and fees is available upon request. Please See Important Disclosure Information here.